Vietnam Tech Investment - H1 2019

Cento Ventures has been tracking data on digital investment activity in Southeast Asia for several years, some of which we had the pleasure to share through Cento’s Southeast Asia Tech Investment Reports. This year, we continue to see the interest from the investment community towards the region, with a strong surge towards one market, in particular, Vietnam.

In collaboration with Vietnam’s leading early-stage venture fund, ESP Capital, we are excited to announce the 2019 Vietnam Tech Investment Report, covering up to the first half of the year.

Click HERE to view the full report

The rise of Vietnam tech investment

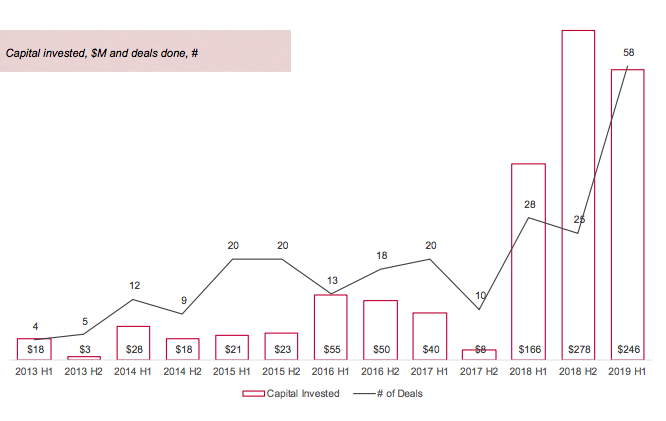

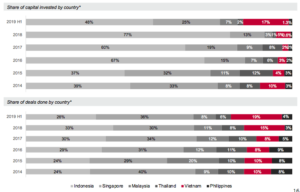

In only 2 years, Vietnam jumped from the second least active startup ecosystem among the 6

In only 2 years, Vietnam jumped from the second least active startup ecosystem among the 6

largest ASEAN countries into no.3, trailing behind only Indonesia and Singapore. The amount of invested capital and the number of technology deals done have grown six-fold from H1 2017 to H1 2019. This report explores different aspects of this impressive growth. For readers who would like to understand how Vietnam performs in the regional context, our Southeast Asia Tech Investment Report is also available HERE.

Capital concentration exists

Vietnam startups raised a total of $246M in H1 2019, of which, 3 largest investments (Tiki, VNPay, VNG) captured 63% of the funding. In terms of sector, the building blocks of the digital economy such as retail and payment captured almost 60% of the period’s investment. Multi-vertical companies are emerging and capture 12% share of capital, while sectors that have been growing in other parts of the regions such as fintech (non-payment), real estate, and logistics are only beginning to pick up in Vietnam, collectively taking 10% share of capital in total.

Companies are approaching later stages

We have been observing a continuous growth in deals across all size. It is worth noting that 2018 and 2019 have also produced a new wave of Vietnam startups that raised $50M to $100M rounds for the first time. If this trend progresses, we will expect to see more Vietnamese companies approaching $0.5B and eventually $1B valuation mark in the years to come.

More diverse mix of investors

In 2017-2018, the majority of deals were from Singapore and Japan-based investors. This year, Korean VCs took the throne as one of the most active investors in H1 2019, having participated in almost 30% of the deals. Interestingly, many of those Korean investors invested in Vietnamese startups for the first time. The local investors were equally active, with participation in ~36% of the deals. The number of deals grew from 13 deals in H1 2018 to 21 deals in the same period of 2019.

Exits are small, but growing

Exit opportunities exist, but the majority are still within the $20M range. However, Yeah1! IPO and Batdongsan acquisition by Propertyguru in 2018 will likely inspire both the local entrepreneurs to build their companies for bigger exits, and potential acquirers to begin looking for large opportunities in Vietnam.

Asia = Key sources of acquirers

Similarly to the investors’ origins dynamic, acquirers in Asia contributes 99% of the exit value and 96% of total acquisitions and secondary deals. Vietnamese acquirers contributed to half of the liquidity events, but only 17% of the value. Acquirers from other Southeast Asia countries, predominantly led by Singapore, contributed up to 66% of exit value. The remaining portion consists of a mix between Japanese and Korean acquirers. As Vietnam’s ecosystem matures, we expect to see a more diverse set of acquirers looking into the country, such as those from Europe, Australia, as well as more exit opportunities from East Asian countries.

Final Note

We hope this report will be helpful to local entrepreneurs, investors, or policymakers who are working hard to drive Vietnam forward, as well as international participants who are looking to understand more about this thriving startups ecosystem and its opportunities.