Southeast Asia Tech Investment – FY2020

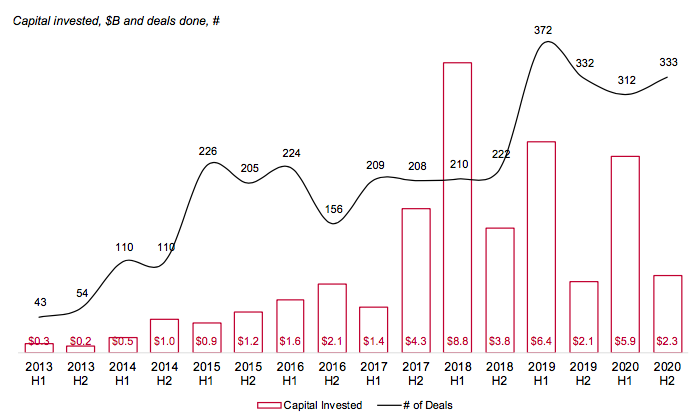

2020 marked our memories with its extraordinary challenges for individuals, families, and organisations. Yet, it was also a year of fortitude and resilience. From data in the first half of the year, we had expected to see a slowdown in technology investment resulting from the COVID-19 related restrictions. Overall, 2020 looks like a very ‘normal’ year for SE Asia tech investment.

Check out the full report here

Stable round sizes

Median round sizes were stable with Pre-A rounds of $0.3M, Series A rounds of $3M, and Series B of $10M. We saw a slight reduction in the share of early stage investment (those sized at less than $3M), with 238 deals in 2020 compared to 281 in 2019.

Indonesia and Singapore regain dominance

2020 confirmed the reversion to the typical geographic distribution of deals. 70% of the capital was invested in Indonesian startups, and Indonesia and Singapore startups combined accounted for 64% of the total number of deals done.

Sector diversification continues

Over half of tech investment flowed to the super-app companies (our ‘multi-vertical’ category) and to online retailers – totalling just over $4B in 2020. Other sectors that saw rising interest included Payments, Logistics and Local Services.

Investment into payments & other financial services startups now forms the largest sector after the multi-vertical one. Sometimes this intersects as the super-apps build their own financial services arms. At present half of investment in this sector goes into payments startups, with the rest spread across the other types of fintech. We have added a breakdown of investment within the fintech sector so we can track its evolution from payment processing and lending, to include a wider range of financial products.

New unicorns

2020 saw JustCo included in Southeast Asia’s companies valued over $1B. We also saw expansion of the group of startups that have exceeded $100M in valuation, adding more than 20 names that included Stashaway, Waresix, Mekari, Shopmatic, Sunday.

Decline in exits

As noted in our report for the first half of the year, liquidity events are where 2020 differed most from previous years. While the number of exits ended up on par with 2018, the proceeds generated fell significantly to under $1B. We think it’s fair to assume that some larger potential deals have been delayed, as the sort of extensive due diligence required by international acquirers was harder to accomplish during this period of travel restrictions.

Looking ahead to 2021

Tech investment may not have reached any new heights in 2020, but startups in the region have risen to the various challenges and proven they can find new opportunities to grow and attract new investment. We anticipate that if the pandemic recedes throughout 2021, we will see resumed growth in VC investment alongside some notable exits, by the time our next report is published in H1 2021.